Financing Modalities Under the ISFL

Overview

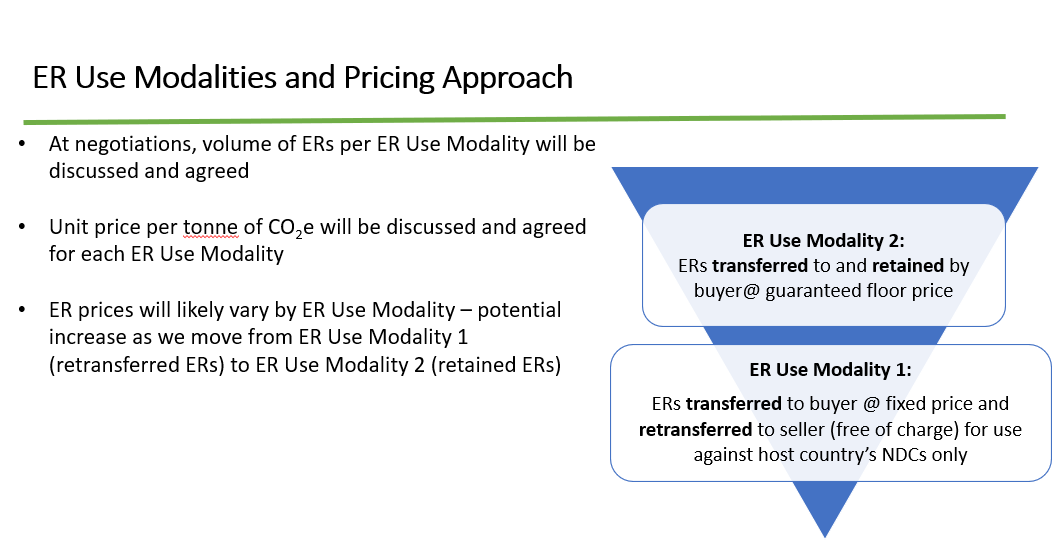

The ISFL provides program countries with both climate finance and carbon finance. Under a climate finance modality, also called ER Use Modality 1 by the fund, the ISFL makes payments for verified ERs but does not retain ownership of these ERs. This means that, after being sold to the World Bank, the ER unit is transferred back to the ISFL program country for use towards its nationally determined contributions (NDCs) under the Paris Agreement. For ERs purchased by the ISFL under a carbon finance modality, however, the ISFL will make payments for verified ERs but will not transfer them back to the ISFL program country, but rather forward them to the donor country who retains ownership of the verified ERs. As such, ISFL program countries selling ERs under a carbon finance modality, also called ER Use Modality 2, will not be able to use these ERs to fulfill their NDCs, which creates an opportunity cost. Under this modality, program countries must find other climate mitigation opportunities to meet their emission reduction goals, so they may demand a higher price for ERs.

Regardless of the ER use modality being used, there is a consistent need to ensure the robustness of the verified ERs. For transactions under both climate and carbon finance, ER units must first be verified by a third party to ensure that they have met the necessary standards. Under the ISFL, the verification standard that is used is provided by the ISFL ER Program Requirements, a public document outlining the ISFL’s methodology for ER transactions.

Furthermore, the seller of ERs must demonstrate an ability to transfer the title of those ERs to the buyer (e.g., through ER ownership or transfer authorization) and the right to sell the ERs generated. This can be achieved in a variety of ways, including referencing the appropriate legislation or even issuing new legislation if there is currently none.